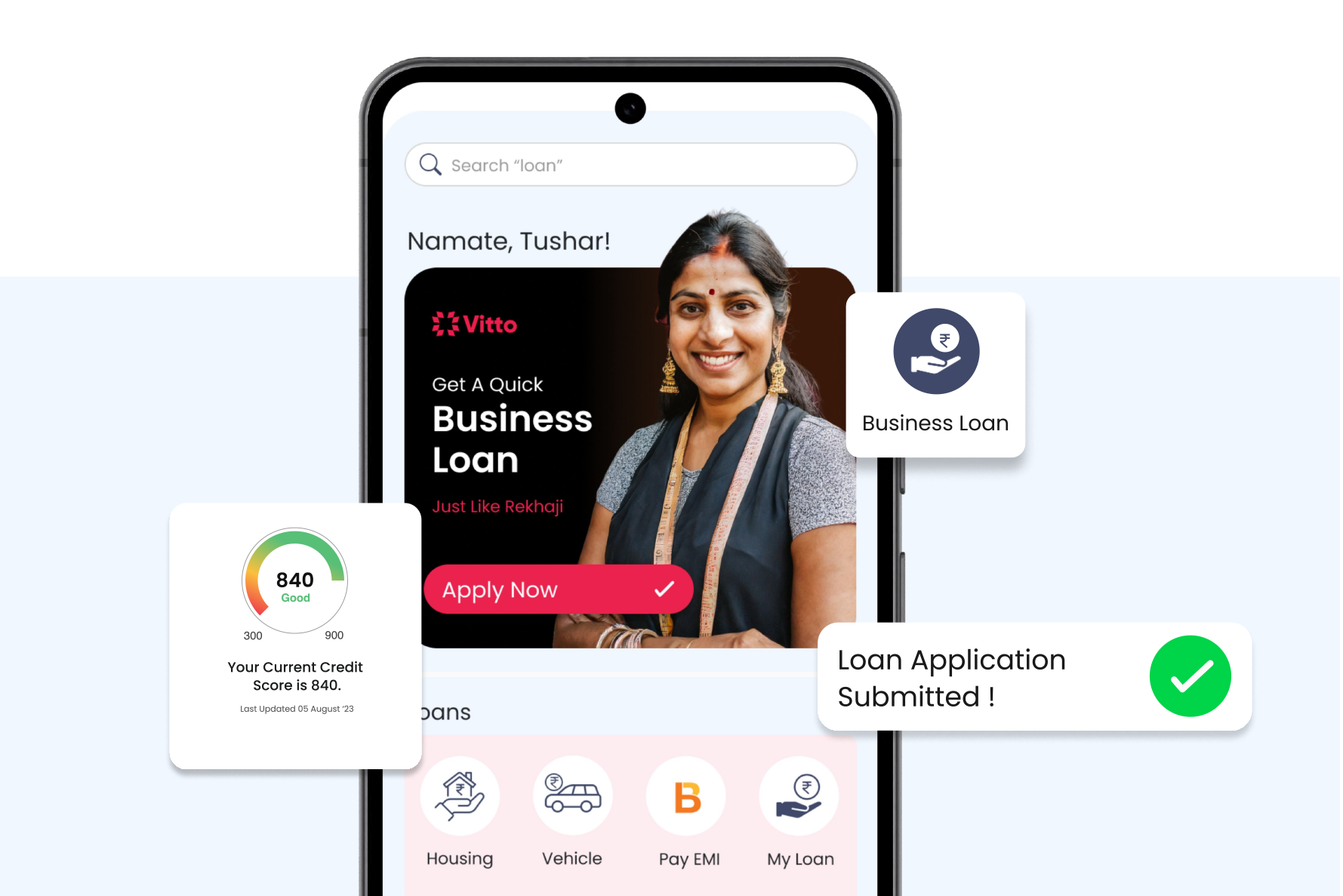

Get your Business Loan with Vitto's AI Powered Assistance

Empowering your business with quick, personalized funding using alternative data and AI insights

Follow our quick, AI-guided process for business loans in just five simple steps—easy, fast, and fully transparent.

Start your application process by uploading your PAN Card and Bank Statement for the past 6 months of the business(in PDF format) on the Vitto application.

By uploading your bank statement, we will analyze your statement and determine your eligible amount.

The necessary documents for the loan agreement: Sanction letter, and Lender-borrower agreement(LBA) are documented properly, followed by e-Nach/UPI Autopay

Final review of the entire application and loan amount will be disbursed into your bank account.

Vitto Money focused on empowering micro-borrowers by providing them with access to affordable credit, financial education, and additional financial services such as insurance and savings. They aimed to enhance financial inclusion and promote entrepreneurship among micro-entrepreneurs, particularly women-led enterprises.

Choose Vitto for business loans that are quick, flexible, and AI-driven. We leverage alternative data to offer customized financing, allowing you to access capital with ease, even if traditional credit requirements have been a barrier. With transparent terms and a straightforward application, Vitto empowers your business to grow.

Our streamlined loan lending process involves zero paperwork, you can apply in minutes.

Fast evaluation, response within 24 hours with swift decision- making.

Funds get transferred promptly in a maximum of three days.

lower than industry standards, affordable repayment options.

Unsecured loans, no risk to personal assets.

Step-by-step explanation in the preferred local language for better accessibility.

To qualify for Vitto's Digital Business Loan, your business should be registered and operating within Vitto's service locations, meet the minimum revenue requirements, and have a favorable credit history.

Vitto's digital process ensures a quick turnaround, with loan approvals typically completed within 24-48 hours, helping you access funds swiftly for your business needs.

You'll need to provide basic business registration details, financial statements, and bank statements. Vitto's simplified documentation process ensures fast and efficient processing.

Vitto's Digital Business Loan offers competitive rates, a streamlined online application, and quick disbursement, empowering businesses with the capital needed to grow efficiently.